Homeowners Insurance in and around Homestead

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and the things inside it. If your home is affected by a burglary or a fire, you might have damage to the items in your home as well as damage to the home itself. Without adequate coverage, the cost of replacing your items could fall on you. Some of the things you own can be protected from theft or loss outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Protect what's important from the unanticipated.

Give your home an extra layer of protection with State Farm home insurance.

Safeguard Your Greatest Asset

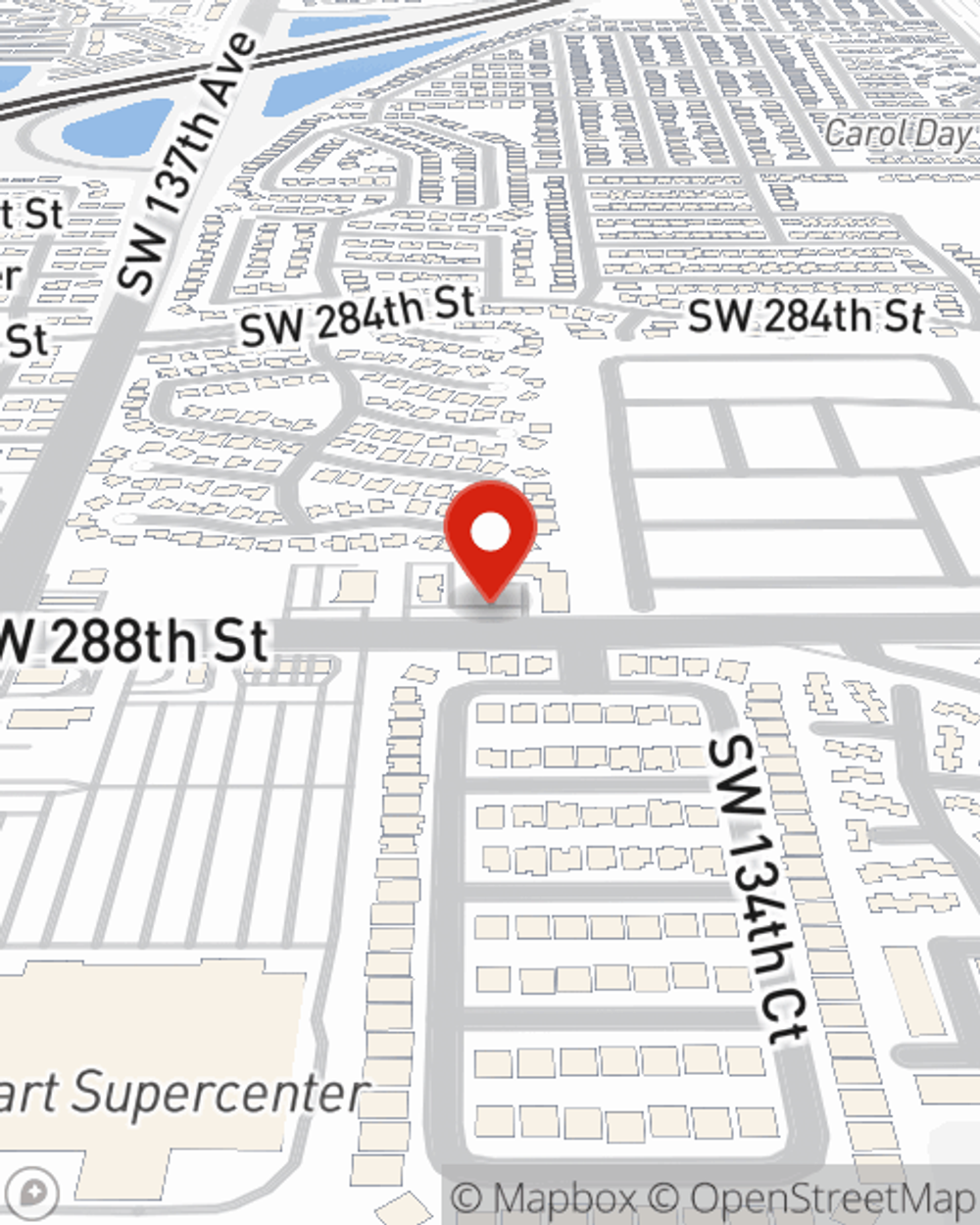

If you're worried about what could go wrong or just want to be prepared, State Farm's dependable coverage is right for you. Producing a policy that works for you is not the only aspect that agent Dan Carrera can help you with. Dan Carrera is also equipped to assist you in filing a claim if something does happen.

As your good neighbor, State Farm agent Dan Carrera is happy to help you with understanding the policy that's right for you. Visit today!

Have More Questions About Homeowners Insurance?

Call Dan at (305) 713-1915 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Dan Carrera

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.