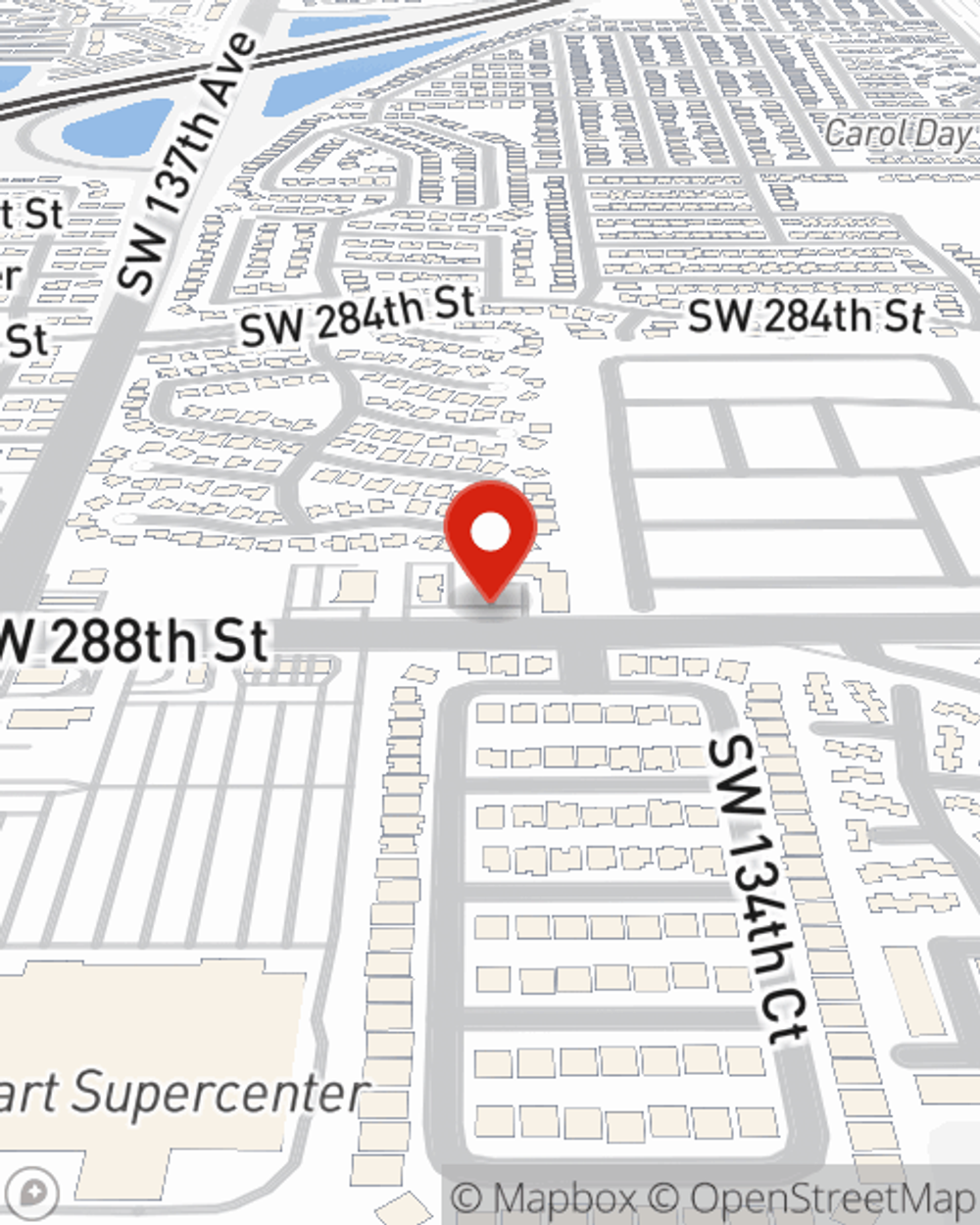

Life Insurance in and around Homestead

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

State Farm understands your desire to help provide for your partner after you pass away. That's why we offer excellent Life insurance coverage options and dependable empathetic service to help you settle upon a policy that fits your needs.

Protection for those you care about

Now is the right time to think about life insurance

Put Those Worries To Rest

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Dan Carrera is waiting to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can be of good use to cover final expenses, such as medical bills or funeral costs, without overwhelming your loved ones. Contact your local State Farm agent Dan Carrera for a free quote on Guaranteed Issue Final Expense..

Have More Questions About Life Insurance?

Call Dan at (305) 713-1915 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Dan Carrera

State Farm® Insurance AgentSimple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.